Federal capital gains tax rate 2021

Theyre taxed at lower rates than short. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals.

. 2021-2022 Capital Gains Tax Rates Calculator 2 weeks ago Feb 24 2018 In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 2021-2022 Capital Gains Tax Rates and How to Calculate Your Bill 1 week ago Aug 05 2022 On top of federal capital gains taxes you may also have to pay state capital gains taxes. Married couples filing jointly.

This amount is eligible to be used either during your life or at death. That means you pay the same tax rates you pay on federal income tax. Go through the API documentation.

Includes short and long-term Federal and State Capital. Experienced in-house construction and development managers. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and. In the US short-term capital gains are taxed as ordinary income.

If your taxable income was 45000 and youre filing as a single person youd pay tax at a rate of 22 on that 2000 in gains for a total tax bill of 440 on your short-term gains. That means you could pay up to 37 income tax depending on your federal income tax bracket. Your 2021 Tax Bracket to See Whats Been Adjusted.

Add this to your taxable. Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less 40400 for. Listing 17 Results Federal Capital Gains Tax Rate 2021 Total 17 Results Google Api Bing Api 1.

The federal government taxes long-term capital gains at the. Meanwhile for short-term capital gains the tax brackets for ordinary income taxes apply. On top of federal capital gains taxes you may also have to pay state capital gains taxes.

Ad Compare Your 2022 Tax Bracket vs. Short-Term Capital Gains Rates. The actual rates didnt change for 2020 but the income brackets did adjust slightly.

Some or all net capital gain may be taxed at 0 if your taxable income is. Short-Term Capital Gains Tax Rates 2021. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

Long-term capital gains are gains on assets you hold for more than one year. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Capital gains and losses are taxed differently from income like wages. Here are the 2021 capital gains tax brackets and rates. The top marginal income tax rate of 37 percent will.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. Discover Helpful Information and Resources on Taxes From AARP.

First deduct the Capital Gains tax-free allowance from your taxable gain. Select the plan with the price. In the United States of America individuals and corporations pay US.

Experienced in-house construction and development managers. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding.

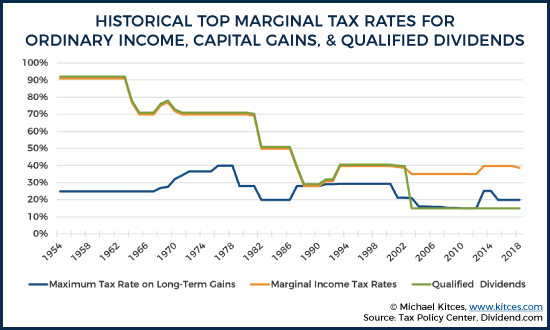

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

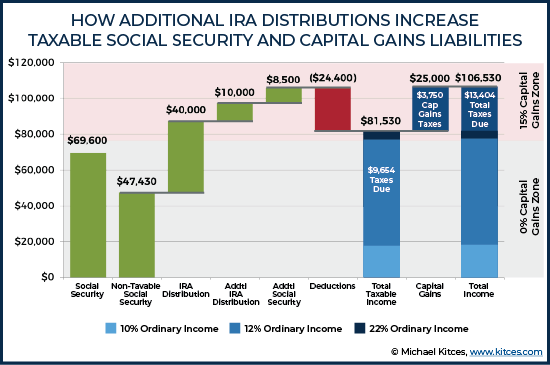

The Tax Impact Of The Long Term Capital Gains Bump Zone

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Tax 101

What You Need To Know About Capital Gains Tax

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

State Taxes On Capital Gains Center On Budget And Policy Priorities

How Are Dividends Taxed Overview 2021 Tax Rates Examples

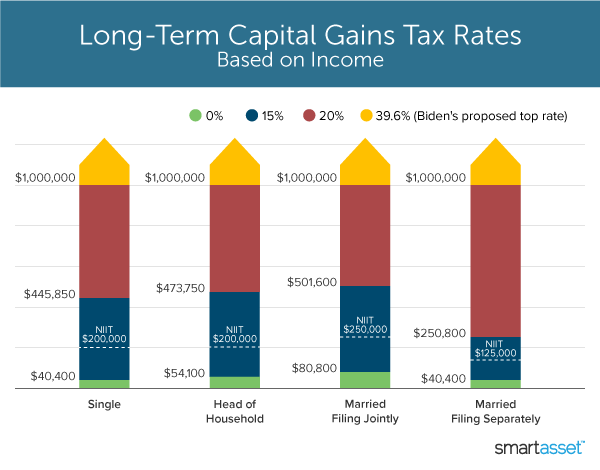

What S In Biden S Capital Gains Tax Plan Smartasset

What You Need To Know About Capital Gains Tax

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Federal Income Tax Income Tax Return

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

The Tax Impact Of The Long Term Capital Gains Bump Zone

What You Need To Know About Capital Gains Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What Are The Capital Gains Tax Rates For 2020 And 2021 Noticias Financieras Wall Street Estados Financieros